The Blog

Learn the Basics of Long-Term Care

News

Oct. 04, 2023

A proactive plan can make all the difference for you and your loved ones. Understanding what long-term care is and considering the costs are important first steps in building a plan that’s right for you.

Understanding long-term care1

Long-term care is a range of services and support designed to meet your health or personal care needs during a short or long period of time. Most long-term care needs do not relate to medical care aid, but rather assistance with the Activities of Daily Living (ADL) such as bathing, dressing, caring for incontinence, using the toilet, transferring, and eating.

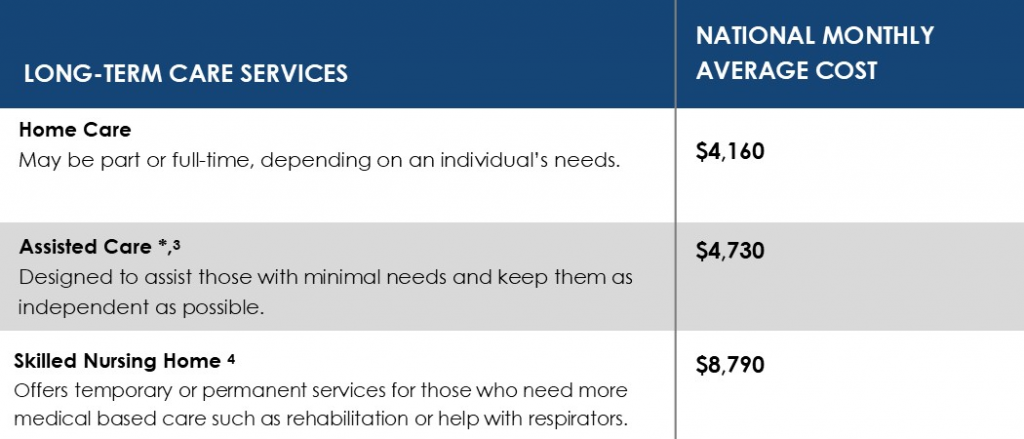

Know the costs2

When planning for long-term care, it’s important to consider the costs associated with the type of care you may want, which may vary based on the level of care offered, location and quality of the facility.

Benefits of long-term care planning

- Rest assured knowing you have a strong, proactive plan customized for your needs

- Deliver care coverage and legacy protection

- Prevent your family from reactively guessing at your care preferences, or needing to become your caregiver

- Safeguard your retirement dollars from the rising costs of care5

Did you know?

94% of financial professionals agree that people wait too long before discussing plans and options for long-term care.6 Let’s start the conversation. Contact our Lincoln Financial Advisors here.

1 Subject to a plan of care prescribed by a licensed health care practitioner.

2 LTCG, “2020 Lincoln Financial Cost of Care Survey,” March 2020, https://www.whatcarecosts.com/lincoln. For a printed copy, call 877-ASK-LINCOLN. All averages shown in the chart are from this survey.

* Note that in California this type of facility is licensed as a residential care facility.

3 Cost based on a one-bedroom facility, from survey noted in 1 above.

4 Cost based on a private room, from survey noted in 1 above.

5 Inflation protection option; additional cost applies.

6 Versta Research, “2020 LTC Marketing and Thought Leadership Research, Findings from Surveys of Advisors and Consumers,” October 2020. For a printed copy, call 877-ASK-LINCOLN.

Farmers & Merchants Bank and Lincoln Financial Advisors have formed a strategic alliance. While the two firms will work together to

provide you with the best service possible, each firm is independently responsible for the services offered.

Michael Devere and Chase Young are registered representatives of Lincoln Financial Advisors Corp. Securities and investment advisory

services offered through Lincoln Financial Advisors, a broker-dealer (member SIPC) and registered investment advisor. Insurance

offered through Lincoln Marketing and Insurance Agency, LLC and Lincoln Associates Insurance Agency, Inc. and other fine companies.