The Blog

The Perceived Risks of Long-term Care

News

Oct. 09, 2023

People care about their loved ones and want the best for them. Yet many adult children don’t know their parents’ intentions and often spouses are not on the same page. When there’s no plan in place, relatives may find themselves in the difficult position of having to make health-related and financial decisions for an ailing loved one.

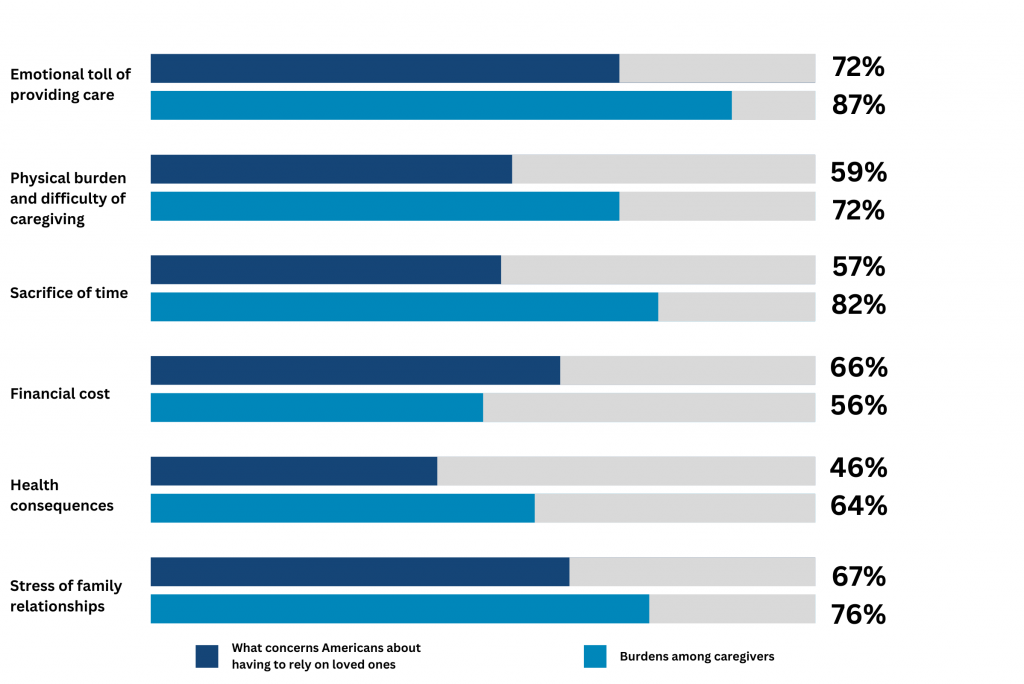

It’s no wonder that Americans are concerned about becoming a burden when they think about potentially needing care and family members becoming their caregivers.

The Perceived Risks of Associated with Long-Term Care*

When to Get Started

Get your loved ones engaged in conversations about planning while everyone is still healthy. A good time to begin the process is when you feel confident that you will reach your retirement goals. The next step is to consider what could derail your retirement.

Discuss What’s Important in Your Plan

- Care: Let your loved ones know your preference. Learn what the costs of different types of services are when and where you plan to retire. Visit the cost of care map: www.whatcarecosts.com/lincoln. Enter sponsor code: Lincoln.

- Caregiving: While caregiving is very noble, long-term care can involve some of the most intimate aspects of daily living, and many feel they’re incapable of providing the care of a loved one would need. Tip: Share your expectations with your loved ones and encourage them to share their thoughts with you.

- Health-related decisions: Designate who has authority to discuss medications and treatment and inform your physicians. Give your designee the contact information for your doctors.

- Finances: Let your loved ones know you will cover the costs of care. Also establish who will have the authority to manage your finances, such as paying the household bills.

- Legal Matters: Make sure you and your loved ones have a living will, a current will, a durable power of attorney, and a power of attorney for healthcare.

Are You Ready to Take the Next Step?

Schedule a meeting with our financial professionals. They have extensive experience in planning for long-term care and can provide a wealth of knowledge and show you a variety of planning options.

*VerstaResearch, “2020 LTC Marketing and Thought Leadership Research, Findings from Surveys of Advisors and Consumers,” October 2020. https://visit.lfg.com/MG-VRST-PPT001.

Farmers & Merchants Bank and Lincoln Financial Advisors have formed a strategic alliance. While the two firms will work together to

provide you with the best service possible, each firm is independently responsible for the services offered.

Michael Devere and Chase Young are registered representatives of Lincoln Financial Advisors Corp. Securities and investment advisory

services offered through Lincoln Financial Advisors, a broker-dealer (member SIPC) and registered investment advisor. Insurance

offered through Lincoln Marketing and Insurance Agency, LLC and Lincoln Associates Insurance Agency, Inc. and other fine companies.